COVID-19 Information and Resources

Ripon Main Street, Inc., along with our partners at the Wisconsin Economic Development Corp. (WEDC), and Envision Greater Fond du Lac, is closely monitoring developments regarding the spread of COVID-19. Main Street is deeply concerned with the impact cancellations and quarantines are having on our community. The wellbeing of our customers, businesses and property owners is of the utmost importance to us. Providing credible updates from reliable sources is our primary goal. We will provide new information as it becomes available, and will update this page on a continuous basis.

Craig Tebon, Executive Director

Ripon Main Street, Inc.

920-748-7466

craig@riponmainst.com

We’re All In Small Business Grants – Phase 2

Applications are being accepted the We’re All In Grant Phase 2 program. The second phase of the program will provide $5,000 grants to 10,000 businesses to help with pandemic-related costs, including health and safety improvements, wages and salaries, rent, mortgages and inventory. Unlike Phase 1 of the program, small businesses will not be required to upload documents or submit a letter of support from a local community organization. The We're All In Grants ARE NOT awarded on a first-come-first-served basis. Applicants should familiarize themselves with the eligibility requirements and limitations of the program, as well as the information and documentation required to apply, all of which can be found along with the grant application at https://www.revenue.wi.gov. The application process closes at 11:59 pm on November 2. If you are not to apply online, you may request assistance by calling the Wisconsin Department of Revenue at 608.266.2772.

To apply, go to: We're All In Small Business Grant - Phase 2

Guidance for when an Employee Tests Positive for COVID-19

Link: What to do when a COVID-19 positive case is identified

Fact Sheet - Next Steps: After Being Diagnosed with COVID-19

Link: Next Steps: After you are diagnosed with COVID-19

Fact Sheet - Next Steps: Identifying Close Contacts

Link: I tested positive for COVID-19. What can I do to help notify my close contacts of their exposure?

Fact Sheet - Next Steps: Close contacts of someone with COVID-19

Link: What does it mean to be a “close contact” of someone with COVID-19?

Resources

The situation with Coronavirus (COVID-19) continues to evolve, and Ripon Main Street, Inc. has been monitoring the situation as presented by the Center for Disease Control, World Health Organization, Wisconsin Department of Health Services.

Healthcare Resources

State of Wisconsin Department of Health Services

Fond du Lac County Health Department

If you have any general questions about COVID-19, call 211. If you believe you have been exposed or are experiencing symptoms such as fever, cough and shortness of breath, call 844-225-0147.

Agnesian Healthcare, a member of SSM Health Fond du Lac

Community Resources

COVID-19 Ripon Main Street, Inc. Information and Resources - Information and Resources.

COVID-19 von Briesen Task Force - a great resource for updates and descriptions of programs related to COVID-19.

Envision Greater Fond du Lac - Information and Resources

Envision Greater Fond du Lac Micro Loan Program - for businesses impacted by COVID-19 that are located in Fond du Lac County. Loans are up to $5,000 (while funds are available). Link

Ripon Chamber of Commerce Information Page - Information and Resources.

Ripon Community COVID-19 Task Force - strives to meet current and emerging needs related to the pandemic in Ripon, Wisconsin.

Reopening Guidelines for Wisconsin Businesses

Wisconsin businesses look forward to a future when they can return to providing the products and services their customers need and crave, unencumbered by threats to the health of their employees and those they serve. Working toward that future will require the gradual adoption of new business practices that reflect the evolving reality of the COVID-19 pandemic and our success in mitigating the effects of this unprecedented global health emergency.

With input from national and state health and industry experts and in partnership with the Wisconsin Department of Health Services, the Wisconsin Department of Agriculture, Trade and Consumer Protection, the Wisconsin Department of Tourism and our regional economic development partners, Gov. Tony Evers announced Friday, May 8, 2020 that a series of industry-specific documents had been compiled by WEDC to help businesses prepare for reopening. The guidelines outline the necessary precautions businesses should take to maximize safety. Following these guidelines will help get Wisconsin’s economy back on track.

Bookmark the Reopening Guideline page and check back regularly for updates to guidelines and the addition of new industry documents.

• General Guidance For All Businesses - Best Practices To Reopen

Guidelines for Specific Business Categories

• Recommendations for Restaurant and Food Service Businesses

• Recommendations for Retail Stores

• Recommendations for Hair and Nail Salons

• Recommendations for the Professional Services Industry (Commercial Office Spaces)

• Recommendations for Manufactures

• Recommendations for Warehouse and Wholesale Trades

• Recommendations for Lodging Businesses

• Construction Industry Guidelines

• Recommendations for Gyms and Fitness Facilities

• Guidance and Resources for Agriculture

• Recommendations for Public Facilities

• Recommendations for Entertainment and Amusement

• Recommendations for Outdoor Recreation

• Recommendations for Transportation

• Recommendations for Outdoor Gatherings

WEDC Offers We're All In Small Business Grants

Below is an update regarding the We’re All In Small Business Grants. Small businesses throughout Wisconsin are able to apply for a $2500 grant from the Wisconsin Economic Development Corporation (WEDC). As mentioned below, this is a great opportunity to gather the required information so applications can be submitted as early in the process as possible. Ripon Main Street would be happy to provide a letter of support/acknowledgement. The application process is open through June 23, 2020.

Businesses should review and have available the information listed below prior to applying for the program:

• Have reviewed the criteria for eligibility (https://wedc.org/programs-and-resources/wai-small-business-grant/).

• Have determined the three digit NAICS code that applies to their business (https://www.naics.com/naics-code-description/).

• Have downloaded and signed a W-9 (www.irs.gov/pub/irs-pdf/fw9.pdf).

• Have a Letter of Acknowledgment from Ripon Main Street, Inc. or other economic development organization indicating your business was in operation in February 2020 (contact Craig Tebon for help).

• Have gathered all of the necessary documents to apply as once they start an application, they will need to complete it. They cannot save it and complete it later.

Eligibility:

A business may apply for the We’re All In Small Business Grant if it:

• Was in business in February 2020. Businesses that started in 2020 are not eligible.

• Is Wisconsin-based and for-profit.

• Employs 20 or fewer full-time equivalent (FTE) employees, including the owner.

• Has more than $0 but less than $1 million in annual revenues.

To prepare for the online application process, businesses should be ready to upload the following documents to the WEDC application:

• 2018 or 2019 federal tax return for business. (If you started your business in 2020, you are not eligible for this grant.)

• Signed W-9 form available at https://www.irs.gov/forms-pubs/about-form-w-9

• An email or letter of acknowledgement from a community organization indicating your business was in operation in February 2020. Letters or emails can be from any of the following:

~ Main Street or Connect Communities organization

~ Local business improvement district

And finally, grants are NOT being awarded on a first come, first served basis so a business can apply anytime during the application period from 8:00 a.m. on Monday, June 15 through 11:59 p.m. on Tuesday, June 23.

To apply, go to: We're All In Small Business Grant

*Click the “APPLY NOW” (white arrow in green circle) to access the application.

Wisconsin Safer at Home Order

On April 15, 2020, Gov. Tony Evers directed the Wisconsin Department of Health Services (DHS) Secretary-designee Andrea Palm to extend the Safer at Home order from April 24, 2020 to 8 am on Tuesday, May 26, 2020, or until a superseding order is issued. The order implements some new measures to ensure safety and support the progress being made to contain COVID-19, but also allows certain activities to start up again. The original Safer at Home order can be extended by the governor until May 10th, but needs the legislature’s approval to go beyond that date. Click the link to view the order: Emergency Order #28

While businesses defined in the Governor’s Order as Essential are encouraged to remain open, Nonessential for-profit and non-profit businesses in Wisconsin have been instructed to cease all activities, except for Minimum Basic Operations (i.e. maintaining inventory, preserving the business’s physical plant and equipment, processing payroll and employee benefits, etc.). The Wisconsin Economic Development Corp. (WEDC) provides information regarding essential businesses, minimum basic operations, social distancing requirement, and other FAQs on their Essential Businesses webpage.

Restarting the Local Economy

On April 20,2020, Gov. Tony Evers announced a plan to slowly reopen Wisconsin. The "Badger Bounce Back" plan outlines important criteria for Wisconsin to be able to reopen its economy in phases. The plan includes steps to ensure workers and businesses are prepared to reopen as soon as it is safe to do so.

In addition, Wisconsin Manufacturers and Commerce (WMC) has announced a Back-to-Business Plan for reopening business in the state. WMC worked with business and healthcare interests to design a plan that uses DHS data, census information, hospital capacity and business types to provide a risk review of each individual business. The proposal is also being reviewed by the Fond du Lac County Economic Recovery Task Force. Click the link to view the proposal: WMC Back-to-Business Plan

Main Street will continue to strive to keep you informed as the details are released, and will work with businesses to help implement successful and safe plans to reopen businesses pursuant to such guidelines.

Business Resources

CARES Act Update (April 21, 2020)

The US Senate just reach an agreement today on an additional aid package that will provide $300 billion to boost the Paycheck Protection Program (PPP) and $50 billion for the Economic Injury Disaster Loan (EIDL). Both PPP and EIDL were quickly overwhelmed after they were introduced and quickly ran out of money. This new round of funding also provides $75 billion for hospitals and $25 billion for COVID-19 testing. Under the PPP, loans must be used for the following, within certain time limitations: payroll costs, including benefits (includes salaries, wages, commissions, tips, leave, health insurance, retirement, and state and local taxes on compensation), interest on mortgages, rent and utilities. Contact your local lending institution to begin the PPP application process.

Unemployment funds for self-employed people: The Wisconsin Department of Workforce Development (DWD) started accepting applications today (April 21, 2020) from the self-employed, independent contractors, and workers with limited work history. This program provides an increase in unemployment benefits of $600 per week, in addition to the base amount paid by each state, for four months, and an extension of the time period that a person can receive benefits. Under some circumstances, self-employed people and gig economy workers who normally would not qualify for unemployment benefits, can receive benefits under the new Pandemic Unemployment Assistance (PUA) program. Go to https://dwd.wisconsin.gov/uiben/pua/ to set up your account regarding unemployment insurance benefits.

CARES Act (March 27, 2020)

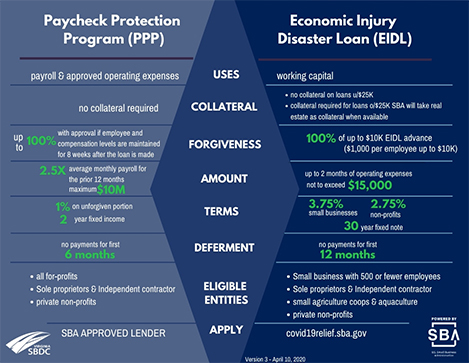

The Senate and Congress recently appropriated over $2 trillion dollars for COVID-19 relief. Below is information provided by the International Economic Development Council (IEDC) explaining two key provisions in the CARES Act that seem to relate most to our businesses:

• Provides a separate $349 billion loan program for small businesses (up to 500 employees) to continue making payroll. A portion of the small business loan can be forgiven depending on how many employees the employer retains. Links to apply for this program are provided below.

• Provides an increase in unemployment benefits of $600 per week, in addition to the base amount paid by each state, for four months, and an extension of the time period that a person can receive benefits. Under some circumstances, self-employed people and gig economy workers who normally would not qualify for unemployment benefits, can receive benefits under a new Pandemic Unemployment Assistance program. Links to apply for unemployment are provided below under Wisconsin Department of Workforce Development (DWD).

Small Business Administration (SBA)

Small Business Administration (SBA)

In response to the Coronavirus (COVID-19) pandemic, small business owners in Wisconsin are eligible to apply for an Economic Injury Disaster Loan "advance" of up to $10,000. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

The SBA’s Economic Injury Disaster Loans (SBA EIDL Program) provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. Businesses may qualify for loans to cover losses resulting from the coronavirus pandemic, and may have up to 30 years to repay the loans. The loans can be used to cover fixed debts, payroll, accounts payable, and other bills that cannot be paid because of the disaster’s impact. Interest rates are 3.75% for for-profit businesses, and 2.75% for nonprofits. Each loan application is considered on a case-by-case basis.

• Eligibility expanded to include tribal businesses, cooperatives, ESOP’s, individual contractors, sole proprietors, and private non-profits with less than 500 employees

• Waives credit elsewhere requirement for advances and loans below $200,000

• Waives personal guarantee for advances and loans below $200,000

• Waives 1-year-in-business requirement for advances and loans below $200,000

• SBA has greater flexibility in determining borrower eligibility

• Entities eligible to apply for EIDL may request an advance in the form of an emergency grant of up to $10,000 ($1,000 per employee up to $10,000)

• SBA must distribute EIDL emergency grant within 3 days

• Applicants are not required to repay emergency grant (advance), even if they are ultimately denied EIDL

Paperwork needed to apply for SBA Disaster Loan Program:

~ Tax Information Authorization (IRS Form 4506T) for the applicant, principals and affiliates

~ Complete copies of the most recent Federal Income Tax Return

~ Schedule of Liabilities (SBA Form 2202)

~ Personal Financial Statement (SBA Form 413)

~ Profit and loss statements

~ Monthly sales figures (SBA Form 1368)

Print out and review the Application Worksheet provided by Envision Greater Fond du Lac before logging into the online portal. This will allow you to assemble the required information which will be needed to complete the form. The link to the portal to apply for the SBA Disaster Loan is: www.sba.gov/disaster

Unfortunately, the SBA site is slow, but please don’t let that stop you from applying for funds to help cover your loss.

Additional SBA Information:

• SBA Disaster Assistance in Response to the Coronavirus - HANDOUT

CARES Act Paycheck Protection Program

With the passing of the CARES Act, the Paycheck Protection Program (PPP) is designed to keep the US workforce employed. PPP allocates $350 billion to support emergency loans to qualifying businesses. Through PPP, the SBA has the authority to provide 100% federally backed loans to help eligible businesses pay operational costs such as payroll, rent, and utilities. Portions of the loan are forgivable If a business satisfies certain conditions. The SBA will be administering the disbursement of loans through approved lenders.

Beginning April 3, small businesses and sole proprietorships can apply for and receive forgivable loans under the PPP. Beginning April 10, independent contractors and self-employed individuals may do the same. Loan details include:

• Loans can be for up to two months of average monthly payroll costs from the last year, plus an additional 25 percent of that amount, subject to a $100,000 per employee cap and a $10 million total cap.

• Interest rates are fixed at 0.50 percent.

• All payments are deferred for the first six months.

• There are no prepayment penalties or fees.

• No collateral is required.

• No personal guarantee is required.

• Loans are due in two years.

• Each eligible entity is limited to a single PPP loan.

To take advantage of loan forgiveness, loans must be used for the following, within certain time limitations: payroll costs, including benefits (includes salaries, wages, commissions, tips, leave, health insurance, retirement, and state and local taxes on compensation), interest on mortgages, rent and utilities. Contact your local lending institution for details.

SBA Paycheck Protection Program Info: Paycheck Protection Program

Envision Greater Fond du Lac - Information and Resources

Envision Greater Fond du Lac Micro Loan Program

Envision Greater Fond du Lac has established loan program for businesses impacted by COVID-19 that are located in Fond du Lac County. Loans are up to $5,000 (while funds are available). Please click the link if you are interested in applying for a loan. Contact Jim Cleveland at 920-322-8681 if you have questions or need assistance. Link

Kiva is a crowd-lending platform that provides 0% loans to small businesses through a platform of online lenders (local and global). Effective immediately, U.S. applicants for a Kiva loan will have access to the following expanded lending options in response to the pandemic:

• Expanded eligibility: More businesses will be eligible for a Kiva loan.

• Larger loans: The maximum loan on the Kiva platform will increase from $10,000 to $15,000.

• Grace period: Applicants may receive a grace period of up to six months for greater financial flexibility.

Women, minority and veteran-owned businesses may also have access to a 50% match, up to $5,000, from WEDC. To apply for a loan or sign up to be a lender yourself, visit kiva.org. Link

Wisconsin Restaurant Association (WRA): WRA Coronavirus Update for Restaurants in Wisconsin - a great resource for programs related to dealing with COVID-19, including links to best practices, employer/employee resources, etc.

The National Restaurant Association Educational Foundation has created the Restaurant Employee Relief Fund (“Fund”) to help restaurant industry employees experiencing extraordinary hardship in the wake of the coronavirus disease (COVID-19) outbreak. Through this Fund, one-time grants of $500 will be made to restaurant industry employees who have been impacted by COVID-19, including a decrease in wages or loss of employment. Grants will be awarded as soon as possible to those individuals who meet the prescribed eligibility criteria, as reviewed and verified by the National Restaurant Association Educational Foundation (NRAEF). This Fund is operated by the NRAEF, whose mission is to attract, empower and advance today’s and tomorrow’s restaurant and foodservice workers. Application - Click Here

Additional Resources

Wisconsin Department of Workforce Development (DWD)

Unemployment Insurance The stimulus bill offers considerable resources related to unemployment insurance. At present, this section includes final sticking points that are delaying passage of the bill.

• Creates a temporary Pandemic Unemployment Assistance (PUA) program for those not traditionally covered by unemployment insurance (UI), including the self-employed, independent contractors, or those with limited work history

• Provides an additional $600 per week in recipients of UI and PUA for up to 4 months ~ Provides an additional 13 weeks of UI after state UI expires

• Federal government will cover 100% of the cost of the first week of UI if states waive the one (1) week waiting period to begin benefits

• Federal government will reimburse states for 50% of the costs incurred through 12/31/20 of unemployment benefits for state agencies and non-profits

• Federal government will pay 100% for ‘short-time’ programs in states with exiting programs in law and 50% of costs for states that begin ‘short-time’ programs during the covered period

For Businesses: A series of tax credits to ease the burden of keeping staff on payroll.

• Employee retention benefit: 50% refundable payroll tax credit during COVID-19 crisis for businesses that either fully or partially shut down OR have a 50% decrease in receipts versus the same quarter in the previous year and continue to pay employees.

• Based on qualified wages paid to employees during crisis, tied to number of employees (100+ full time employees = wages paid when they are not providing services due to COVID-19 and less than 100 full time employees = wages paid regardless of business closure status)

• Covers up to $10,000 paid per employee, including benefits, for the period 3/13/20-12/31/20

• Payroll tax deferred, payments to be spread over 2 years

• Net operating losses (NOLs) modification: NOLs arising in FY’s ‘18, ‘19, and ‘20 can be carried back 5 years

• AMT credits available as refundable credits through 2021 can be claimed as a refund now

• Allowable deductible interest expenses are increased from 30% to 50% for 2019 and 2020.

Frequently asked questions about the COVID-19 Coronavirus and Wisconsin Unemployment Benefits. Link

Go to https://my.unemployment.wisconsin.gov/ to set up your account regarding unemployment insurance benefits.

Centers for Disease Control and Prevention

• About Coronavirus Disease 2019 (COVID-19)

• Interim Guidance for Businesses and Employers

• Handwashing: Clean Hands Save Lives

• Coronavirus Disease 2019 Information for Travel

• Centers for Disease Control and Prevention (printable resources)